AN ARTICLE BY KAVITA NAGPAL

It is a known fact that to have a robust DIB, it is essential for any country to have a strong and active private sector in defence manufacturing as well as R&D. In India, however, this has not been the case with which has always prioritized the Public Sector – Ordnance Factories, Defence Public Sector Undertakings and DRDO & its Labs despite their underperformance at times, due to the so-called ‘deep-set security concerns’.

Indigenous defence production or Defence Industrial Base (DIB) is the essential components of long-term strategic planning of any country. For India, the heavy dependence on imports is not only alarming from the perspective of strategic policy, but is also a matter of concern from the economic point of view in terms of the potential for growth and employment generation.

Recently as per a recently released report by Stockholm International Peace Research Institute (SIPRI) in March 2023, India has again emerged as the top importer of military equipment in the world accounting for 11% of global arms imports between 2018 and 2022. Rather, as per the SIPRI data, India has been the largest importer of military equipment for more than 30 years.

Keeping in mind the continued dependency of imports, the Government has undertaken a series of policy and process reforms in order to promote indigenous design, development, and manufacturing of defence equipment within the country.

And, in this regard the opening of the defence sector for private sector participation in 2001 can be said to be one of the first major initiative/policy from its end. However, its commitment to a level-playing field falls flat in the absence of concrete / substantial orders to private sector.

Private Sector in Defence Manufacturing: India Vs Advanced Countries

It is a known fact that to have a robust DIB, it is essential for any country to have a strong and active private sector in defence manufacturing as well as R&D. And even globally mostly the private sector is seen to be the mainstay of the defence production.

Rather, in advanced countries such as US, Israel, China, defence production is dominated by a private companies backed by a plethora of small firms. They have long term partnerships with their governments in both production and Research & Development (R&D).

This is one of the reasons these countries have been able to develop a strong and capable DIB and consequently able to manufacture sophisticated world class military hardware. Further, these countries have also been able to successfully harness the energies of the private sector for R&D.

The most well-known example is the Defence Advanced Research Projects Agency (DARPA) of the US Department of Defence which created a transformational innovation ecosystem in partnership with the private sector with regulatory control over Intellectual Property Rights (IPR) and export.

Image Source: https://www.investindiagov.in/

In India, however, this has not been the case with which has always prioritized the Public Sector – Ordnance Factories, Defence Public Sector Undertakings (DPSUs) and DRDO & its Laboratories despite their underperformance at times, due to the so-called ‘deep-set security concerns’.

These government financed and protected production agencies has been unable to meet the military needs all by themselves. Even when defence products are manufactured domestically by them, there is a large import component in them.

This situation can only be averted if the government put more impetus on involving the private sector to compete in future defence programmes rather than being biased towards the Public Sector entities.

Emergence of Competent Private Sector

Undoubtedly, the private sector companies, seems to have potential and have started giving a tough competition to the Government sector entities. These companies have proved their mettle and even in the sphere of defence exports the share of these entities is witnessing a growth every year.

As on date, approximately $3 billion worth of defence items are being manufactured by the domestic private sector.

Considering the last few years, the Indian private sector is considered to have matured sufficiently both in terms of size and scale of operations as well as in technology development through partnership, adaptation, and assimilation capabilities, making it more capable than ever before.

This is evident from the fact that certain private companies have demonstrated capability such as Pinaka development by Tata Power SED and successful manufacturing of K-9 Vajra Artillery Guns and M-777 ULH by Larsen & Tourbo (L&T) and Mahindra respectively through partnership with OEMs South Korea’s Hanwha and US BAE Systems.

Now, what is required is that the Government should provide much required ample support so that such competent private sector companies remain functional with their order books remaining firms.

However, one also cannot also overlook the fact that till date debarring two-three defence private companies, not many firms have been able to come out with a complete indigenously produced weapon or technology. This is because developing of defence hardware by these companies on their own at this juncture seems relatively impossible since they are still on learning trajectory.

Also, most of the private sector companies do not possess requisite experience, technological advancements and even capital or infrastructure to develop a complete world class defence hardware on their own.

As of now, we can say that the Indian private sector is capable of building ‘system-of-systems’. For instance, a complete communication solution for a submarine or a whole variety of weapon turrets for FICV.

So rather than focusing on developing the entire defence hardware these companies should focus on these area as they should keep in mind that as of now, they on now do not have the capital or infrastructure to waste.

Roadblocks for Private Sector

Worthwhile to point out that most of the private manufacturers lack the incentive to enter and invest into the defence sector considering the risk on returns, the creation of a manufacturing base being highly capital and technology intensive and has a long gestation period, irregular flow of orders, lack of resources and infrastructure, rigorous policies/tax systems coupled with lack of economies of scale in production.

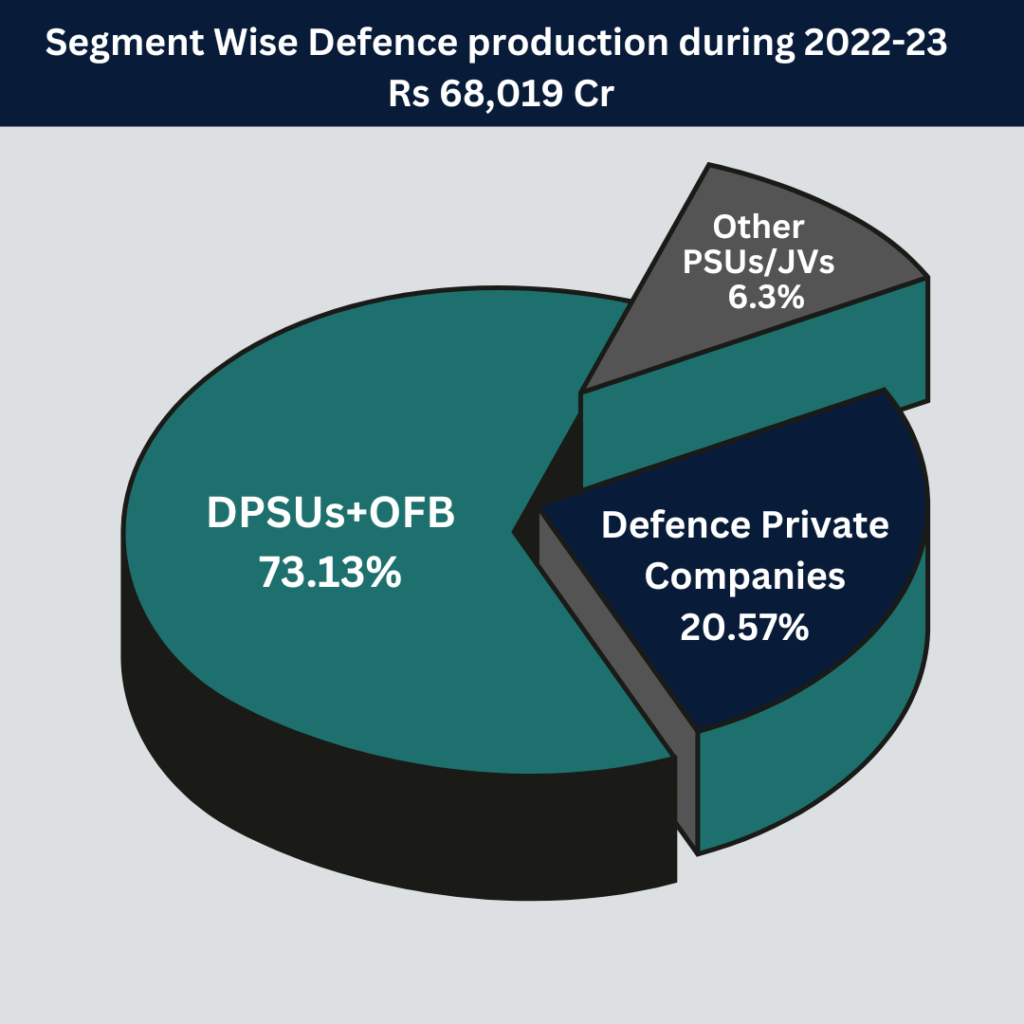

Noteworthy, Indian defence industry output is approx worth Rs 68,019 Crores (2022-23), of which the private sector production is merely approx Rs 13,991 Crores while the public sector produced equipment is worth Rs 49,744 Crores.

|

Year |

DPSUs (in Rs Cr) |

OFB (in Rs Cr) |

Other Public Sector Undertakings/Joint Ventures (in Rs Cr) |

Defence Private Companies (in Rs Cr) |

Total Production (in Rs Cr) |

| 2016-17 | 40,427 | 14,825 | 4,698 | 14,104 | 74,054 |

| 2017-18 | 43,464 | 14,829 | 5,180 | 15,347 | 78,820 |

| 2018-19 | 45,387 | 12,816 | 5,567 | 17,350 | 81,120 |

| 2019-20 | 47,655 | 9,227 | 6,295 | 15,894 | 79,071 |

| 2020-21 | 46,711 | 14,635 | 60,29 | 17,268 | 84,643 |

| 2021-22 | 55,790 | 11,913 | 72,22 | 19,920 | 94,845 |

| 2022-23 | 39,019 | 10,725 | 42,84 | 13,991 |

68,019 |

Source: https://ddpdashboard.gov.in/

Note:- Summation of Annual Sales Turnover as reported by the companies

Given the fact that the Indian domestic defence manufacturing must survive in a monopsony and a monopoly environment, as at the same time the Government is the single largest manufacturer as well as the only buyer; this necessitates specialization and long-term commitment from Government’s end to investment in product development and maintenance.

Defence production and R&D will not make the desired leap, unless the Government proactively supports the private sector in manufacturing and R&D which unfortunately has not been the case.

Though undeniably, the Government has come out with certain measures/policies to boost private sector participation during the last few years such as Make-I, Make-II, Strategic Partnership, Indigenous Design and Development and Manufacturing (IDDM), however, the matter of the fact is that these are still mostly on paper and little headway has been made in this direction.

The much hyped ‘Make in India’ projects involving private sector such as Futuristic Infantry Combat Vehicle (FICV) project, Tactical Communication System (TCS) and Battlefield Management System (BMS), have not seen much progress. The same is the fate of Strategic Partnership (SP). Process involving the selection of the Production agencies, placement of orders is yet to be done such as the Project 75(I) programme.

The Way Forward: A Collaborative Approach

Undeniably, the private sector has shown pioneering success in technological development/advancements but that has been more so through collaborations with foreign OEMs or for the matter of fact with DPSUs/DRDO as well.

The public-private partnership in defence has led to the development of world-class weapons such as Dhanush and the Advanced Towed Artillery Gun System (ATAGS), Pinaka, Aakash missile to name a few.

Understandably, owing to lack of experience, high investment and no assurance of orders that defines the Indian defence sector, the competent and zestful private sector should partner with foreign OEMs. This will help them in getting the technological know-how where it lacks considerably or allowing them to be offset partners.

One such example is of Reliance Defence which tied up with France based Dassult Aviation and has successfully executed offset contract that came with the procurement of 36 Rafale jets for the IAF. The share of Reliance is expected to be around 3% of the Rs 30,000 Crore Dassault Aviation offsets contract.

Private companies like L&T, TATAs, Mahindra, Adani Defence have shown that they have better capability in absorbing the technological know-how. Thus, cutting-edge technologies that have so far eluded Government organizations can be assimilated through foreign investments, acquisitions, and partnerships by the private sector.

Noteworthy, Indian private companies have already proved their mettle in sectors like steel and automobiles; thus, the Government should entrust them and give them more responsibility in developing defence hardware.

It may also be worth mentioning here that the Joint Venture (JV) Company formed by an Indian partner with an OEM must be owned and controlled by resident Indian citizens. The OEM cannot, have more than 49% stake and must also obtain prior license for technology transfer from their own Governments.

These provisions have been proving burdensome for the OEMs as they feel subdued in tying up with Indian firms as they will be reluctant to transfer significant technology for production in India under a JV that gives them insufficient control.

Though, the policy does talk about protecting the property rights of OEMs. But this may not be enough of guarantee. Moreover, at times, the Governments of the OEMs may also be unwilling to permit significant technology transfer under these conditions.

This may result in the OEM choosing to supply the advanced sub-systems and components from abroad while enabling the Indian Strategic Partner to manufacture only lower-end technology in India. Thus, keeping these in mind the Government should permit the OEMs to have higher stake in the JVs they form.

If the question is on ‘national security’ when OEM has more authority in the JV, then it is to be considered that if we can directly buy defence items such as 36 Rafale fighter jets from France, the S400 air defence missile systems from Russia and the attack and strategic lift helicopters (Apache and Chinook) from the US that come readymade from the foreign OEMs with not a single part ‘made in India’.

Then isn’t it better that we allow the foreign OEM to have a tie-up with private company which has a high share of the OEMs but with conditions such as adequate transfer of technology. This way at least we can look forward to some excellent technologies absorption as well as other economic benefits including employment.

One thought on “Private Sector in Defence: A Ray of Hope?”

Comments are closed.